IFRS 16 Lease aspects -4-

This is the fourth report concerning IFRS 16 Lease aspects following two recently published articles, in which the effects of the introduction of IFRS 16 on European companies were examined. See the bottom of the article under ‘Background’.

This is the fourth report concerning IFRS 16 Lease aspects following two recently published articles, in which the effects of the introduction of IFRS 16 on European companies were examined. See the bottom of the article under ‘Background’.

In this report, we highlight three more (one-off!) choices that a company can make if it has opted for the modified retrospective method of transition to IFRS 16.

General principles

With the introduction of (International Financial Reporting Standard) IFRS 16 Leases, a new category of asset has been created in the financial statements: the right-of-use asset.

If the company has opted for the modified retrospective method of transition to IFRS 16, there are three more or less interrelated choices for determining the initial value of the new lease asset, in addition to, see the third report, the portfolio approach and the provision for onerous leases:

- an initial recognition/valuation of the asset with equal value to the lease liability as at 1 Jan. 2019, or calculated retrospectively to the start of the lease;

- correction of the calculated starting value with the (original) initial direct costs;

- retrospective revision of the lease term.

Options 2 and 3 have been widely used. This indicates that the options given were certainly necessary for the introduction of the standard.

Research results

72 Companies were investigated in the articles mentioned, of which 87% (n=63) of the companies has chosen for the modified retrospective method.

Of the surveyed companies, (n=43) 68% valued the lease asset equal to the lease liability.

Of the surveyed companies, (n=39) 62% do not apply any attributable initial direct lease costs in the initial value.

Subsequent revision of the lease term is applied by 57% (n=36) of the surveyed companies.

Initial valuation of lease assets

The researchers observed that, in the vast majority of cases, businesses opted for the ‘simple’ solution of valuing the asset for the same value as the outcome of the calculation of the lease liability.

The researchers observed that, in the vast majority of cases, businesses opted for the ‘simple’ solution of valuing the asset for the same value as the outcome of the calculation of the lease liability.

The calculation of the lease liability will already have caused enough headaches.

The other calculation method forces the company to recalculate the asset value as if IFRS 16 had already been applied from the start of the lease transaction. And, also in this situation, obligatory using the incremental borrowing rate of 1 January 2019.

For the record:

When applying the modified retrospective method, the lessee does not have to show comparative figures and a difference with the situation as at 31 December 2018 is recognized in the opening equity of 2019. When applying ‘lease asset = lease liability’, there is no adjustment via equity.

A disadvantage of the ‘simple’ application is that the costs in the first few years of reporting will be higher than when applying the retrospective calculation method in the case of leases that have been running for a longer period. This is due to the front-running of costs (allocated interest expense + depreciation costs are initially higher than the lease installment to be paid). Companies that lease a lot of real estate, such as supermarket chains, benefit from a retrospective approach.

Attributable initial direct lease costs

The regulations for companies using the modified retrospective method require that when determining the initial value, an adjustment must be made for initial (direct lease) costs attributable to the transaction. The effect of this regulation is that it increases the value of the asset and also increases future depreciation (charged to the profit and loss accounts).

The regulations for companies using the modified retrospective method require that when determining the initial value, an adjustment must be made for initial (direct lease) costs attributable to the transaction. The effect of this regulation is that it increases the value of the asset and also increases future depreciation (charged to the profit and loss accounts).

With the introduction of IFRS 16, companies are allowed to deviate from this.

Of the companies investigated, 22% did not make use of the practical deviation.

For 16% of the companies, it is not possible to determine from the annual accounts whether or not use was made of the exception.

The outcome naturally fits into the picture of keeping the transition simple with “asset = liability”.

Subsequent revision of lease instalments

When applying the modified retrospective method, there is also the possibility to choose for retrospective revision of the lease terms.

When applying the modified retrospective method, there is also the possibility to choose for retrospective revision of the lease terms.

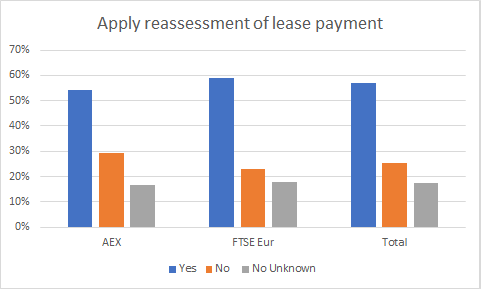

A surprisingly large number of companies (57%) have made use of this option. This is surprising because adjustment is supposed to be made on the basis of factual data (reality) at the time of transition and not on the basis of ‘present knowledge of the situation at the previous time’ (hindsight).

Only 25% of the companies have certainly not made any adjustments to the lease terms.

The 18% of companies that have not provided information will probably not have made any adjustments either, given how complicated adjustment is in practice.

Conclusion

The standard IFRS 16 Leases issued by the (International Accounting Standards Board) IASB in January 2016, which must be applied with effect from 2019 by large, listed companies, contains various practical transitional provisions to simplify the transition. These opportunities have been used to varying, but remarkably large, degrees.

On balance, because of its direct impact on the results for the coming years, IFRS 16 does not deliver the envisaged transparency and comparability.

In this fourth report, too, the painful conclusion is that the (alleged) ambiguity of obligations hidden in operational lease transactions has not been removed.

Background

A number of IFRS 16 Lease aspects are highlighted in a series of reports. The information relates to non-financial companies, which are obliged to apply IFRS regulations; we are therefore specifically talking about large and listed companies.

The first report concerns leases with a residual maturity of up to 12 months and leases with assets of low value.

The second report concerns the first fundamental choice that a company has to make during the transition to IFRS 16.

The third report deals with two initial choices for applying the portfolio approach and a provision for onerous lease transactions, respectively.

The topics discussed in this series are based on two recently published articles in which the effects of the introduction of IFRS 16 on European companies were investigated. The articles concerned are open source and therefore freely accessible and cover a total of 72 investigated annual accounts of companies, 43 of which are non-Dutch. The articles are in Dutch. For the record: the links to the articles can be found in the first report.